Content

A bona-fide house financing faith (REIT) is made when a business (otherwise trust) is created to make use of investors’ currency to purchase, efforts, and sell income-generating features. REITs are purchased and you may sold on big transfers, just like stocks and you can exchange-exchanged money (ETFs). Domestic home spending doesn’t afford the mediocre yearly productivity of other a house assets, such commercial a home, however the very first-go out consumer advantages can make to purchase property more affordable. Income tax laws and regulations and you will regulating pressuresIn European countries, deluxe a home deals appear to encounter intricate and you will active court structures. Trader belief might have been affected by the fresh addition or firming away from laws in regards to overseas ownership, assets taxation, and you can funding growth in some regions.

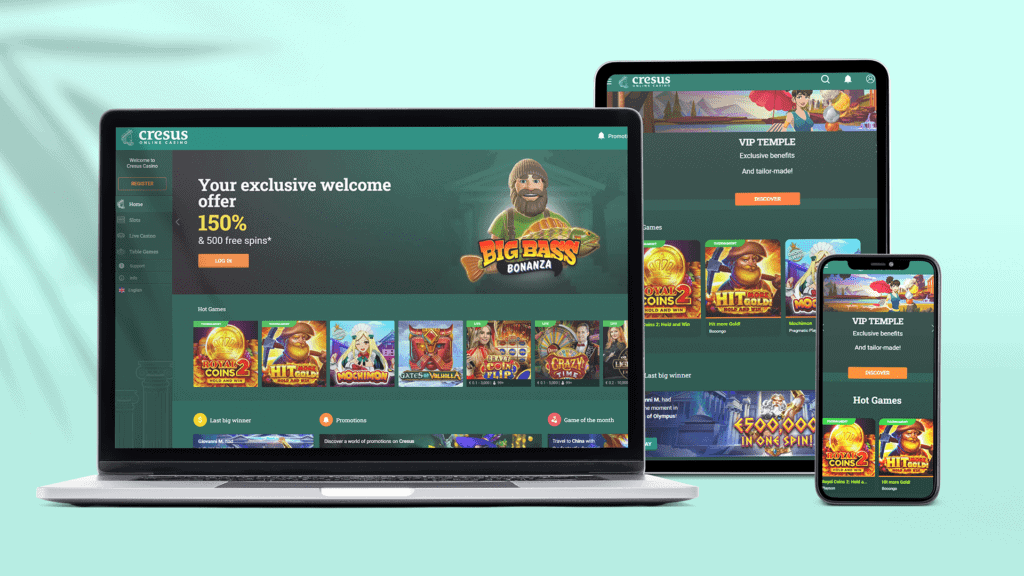

Bingo online casino | Illinois Home-based A house Deals Explained

It may bingo online casino be an otherwise very good financing on the financial in any most other regard, however the bank often nonetheless fight granting the newest fifth mortgage. Difficult money lead lenders are not concerned with exactly how many money possessions fund a debtor provides, he’s simply concerned about helping the borrower achieve the investment wants. Listed below are 3 of one’s prominent REIT holds you might purchase when deciding to take advantageous asset of growing leasing prices in the residential market. In the end, you can consider a property crowdfunding, an investment means where traders pool their funds, typically over thanks to on the internet networks. This enables people to express right up-top can cost you when you’re reaping the advantages of inactive earnings. Inside micro-turning, you purchase property below the potential market price and you will quickly sell them.

Anti-currency laundering steps may enforce extra scrutiny on the deluxe house. Waits, large purchase can cost you, and you may reduced profitability might result from these regulatory demands. High-net-worth people’ procedures will be dependent on erratic interest rates, rising cost of living concerns, and you may geopolitical tensions, particularly when he could be money otherwise having fun with control to find genuine home.

Use the first step toward the best home loan

Because the there’s a top opportunities the NPRM usually become implemented in some setting, realtors must be prepared. Guidehouse as well as reminds loan providers you to definitely support interest to have Revealing People to examine boost necessary controls so that their clients come in conformity which have associated laws. This may are looking at the financial institution’s onboarding and you will homework steps, as well as reviewing investigative tips and transaction- keeping track of legislation.

How come a real house investment works?

Concurrently, this isn’t unusual to possess a monetary companion to need fee as much as fifty% of the winnings if a house is available. A much better course of action always should be to get investment away from a skilled difficult currency head bank and to retain 100% of your own payouts regarding the product sales of your investment property. Domestic a house is actually perhaps the new safest assets type of to expend in the.

- Personal money loan providers could possibly get are not reference personal investors whom dedicate the private funding inside the faith deeds (finance against home).

- All the details here should not be made use of otherwise relied on inside the mention of people kind of items or things instead of first asking a great lawyer.

- Local rental money of trips functions is also present a financially rewarding way to payouts on the a home markets.

- Hard money financing offer much faster approvals compared to conventional funding.

- Hence, which settlement could possibly get feeling how, in which as well as in exactly what purchase things are available within this list kinds, but where banned by law in regards to our financial, home guarantee or other home financial loans.

Using to possess earnings

If truth be told there’s one piece from guidance we can provide the new professionals, it’s to only gamble at the signed up and you may judge real-currency online casinos. It’s worth listing that lots of purchases, and Trustly ACH and you will PayPal, is used at the rear of safer banking sites. This means you’ll join straight to your bank account on the supplier’s website, and all your painful and sensitive advice was hidden regarding the on the internet casino. The new structure has evolved reduced, that have applications merely has just including Multiple-Go up, Ultimate X, and Progressive Jackpot Video poker. Yet ,, casinos on the internet be a little more more likely to provide wider denominations and you may complete-spend dining tables than belongings-based casinos. Most web based casinos only give a number of Baccarat game one generally follow old-fashioned Punto Banco (commission-based) rulesets.

![]()

Personal money loan providers is the wade-in order to selection for experienced home investors looking for a good small and you can reliable supply of fund to invest in the home-based and you may commercial a property opportunities. Hard currency money to possess Ca a home programs is actually a primary-label investment-centered financing, safeguarded from the a borrower’s non-owner occupied possessions. Hard money finance are typically funded by the personal lenders instead of traditional financial institutions or credit unions. Tough money lenders are also sometimes called “individual loan providers.” Tough currency lenders for California home projects provide team objective fund to help you individuals that are collateralized by non-proprietor filled property. Hard money loan providers are designed for to make smaller borrowing conclusion and you will is provide for the services instead current earnings, so they really have a tendency to charges highest rates of interest than just antique banks. When assessing a good borrower’s certificates to own an arduous money financing, lenders bring LTV (loan-to-value) on the personal thought, the amount borrowed divided by worth of the brand new assets.

When you indication an agreement to your buy otherwise product sales away from home-based a property, you will normally have 5 days to examine the newest bargain with your attorney to ensure your own lawyer to change the terms. Below are a few our very own earlier article, Attorneys Amendment out of Domestic Home Agreements, for much more about this matter. In this post, we’re going to talk about the best 5 issues will be for the the appearance away to possess when reviewing the new package together with your genuine property lawyer. Sure, a home REITs will be a no-brainer of these seeking to typical income, portfolio variation, and you can connection with home instead of having assets personally.

He produced the whole process of getting a house financing to the a home inside the probate simple and. Stessa assists both amateur and you can excellent traders make informed decisions regarding the their property profile. Kevin O’Flaherty is a graduate of the College from Iowa and Chicago-Kent College out of Law. They have experience in legal actions, estate believed, bankruptcy, home, and you can complete company symbolization.